Ecommerce fraud has recently increased at roughly double the rate of eCommerce sales. Ecommerce shops need to utilize Ecommerce fraud detection that can prevent and guard against fraud while also assisting with chargeback disputes now more than ever.

It’s critical to take these dangers seriously and devise ways to prevent and mitigate the impact of online fraud on your business. This article is divided into sections for your convenience. Feel free to improve to the one that you’ll find most useful:

I. What Is Ecommerce Fraud

1. What is eCommerce fraud

Any sort of fraud that happens on an eCommerce platform is referred to as eCommerce fraud. Ecommerce fraud includes the use of a stolen or fraudulent credit card, the use of a false identity, and affiliate fraud advertising. When a consumer commits fraud on your online store, you, as the merchant, bear the expense, which has a negative impact on your income.

Online fraud, unlike fraud in a physical place, may be carried out using personal and credit card information, and the card does not need to be present during the transaction. Some kinds of consumer fraud exist, such as friendly fraud, in which a customer files a chargeback on purpose to obtain free goods and avoid payment. Ecommerce fraud detection is a technique that assists e-commerce firms in detecting high-risk transactions by fraud detection and prevention techniques. It complements these with fraud detection systems that use algorithm-based analysis to analyze the possible risk of each transaction.

2. Why is eCommerce fraud prevalent

Fraudsters are growing more intelligent, devising new methods, and becoming more sophisticated with each passing year as everything becomes digital and AI is used. It is simple to steal data and buy information with today’s sophisticated technologies. The use of online aliases makes it difficult to identify and apprehend the perpetrator. In comparison, there are fewer time and budget restrictions on obtaining evidence and prosecuting cases.

Part of the reason for the prevalence of eCommerce fraud detection today is that convictions are uncommon owing to time and resource restrictions, the difficulties of obtaining evidence, and other factors. As a result, eCommerce fraud prosecutions are uncommon, and it is advisable to incorporate a high-quality eCommerce fraud detection and prevention management system to eradicate fraud on your platform and minimize its financial effect.

3. Why is online fraud triggered?

It is self-evident that the expansion of the eCommerce business, as well as the expansion of payment methods such as cards and online payment solutions, is directly connected to a rise in fraud.

According to the research, eCommerce fraud detection has increased dramatically in recent years, with online fraud now outpacing eCommerce revenues by two to one.

The chargeback rate is rising at a pace of about 20% each year. The number of online shopping scams reported to the National Consumer Helpline has nearly doubled from 977 instances in FY17 to 5,620 cases in FY20, bringing the overall number of cases to 13,993 since FY17.

II. Ecommerce Fraud Detection and Prevention Best Practices

1. Check CVV

The card verification value (CVV) or card security code is the multiple security codes on the back of card payments (i.e., VISA®, MasterCard®, and Discover®) and the four-digit security code on the backside of American Express® credit and debit cards (CSC). Businesses may guarantee that consumers have the physical credit card in their hands by requiring all purchases to provide the CVV code for each transaction.

Furthermore, PCI advises merchants not to keep the CVV alongside all of a user’s personal credit card information (e.g., card number and owner’s name), since this is deemed unlawful. In a sense, thieves can’t acquire this code until they have the card in their hands, decreasing the risks of fraud.

2. Use HTTPS

HTTPS is the standard protocol for sending data between a user’s web browser (such as Google Chrome) and an eCommerce website. It’s a secure HTTP version. HTTPS encrypts data to safeguard sensitive information such as customers ’ information, addresses, and credit card details, ensuring that important consumer data is protected from hackers.

Using HTTPS protects the online store’s transactions from being broadcast in a way that hackers, cybercriminals, and fraudsters may readily see. By purchasing an SSL certificate, an online firm may use HTTPS. HTTPS is seen to be a good preventative strategy against less complex internet scams.

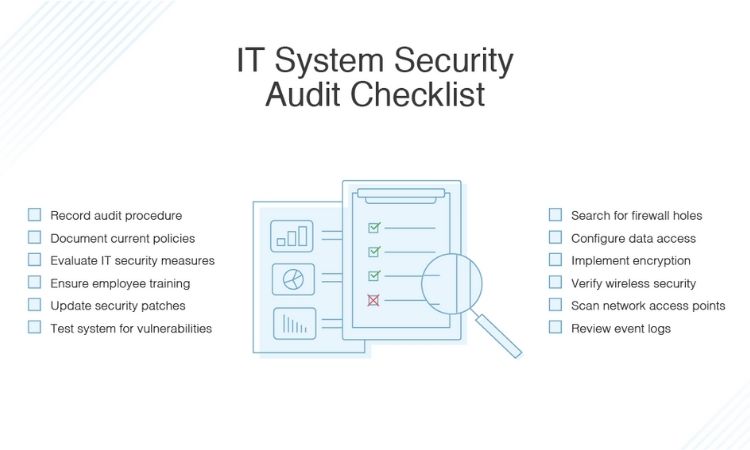

3. Site security audits on a regular basis

By conducting frequent site security audits, eCommerce merchants may detect weaknesses in their security architecture before thieves and fraudsters discover and target them. If such audits are done frequently enough, the following will be ensured:

Check to see if your shopping cart software and plugins are current. Locate both active and inactive plugins to take action against the latter. Validate the SSL certificate’s functionality. Check to see if the online store is PCI-DSS compliant (payment card industry data security standard). Check the frequency of the online store’s backups.

Verify that the passwords for admin accounts, hosting dashboards, CMS, database, and FTP access are strong enough. Verify that the website is checked for malware on a regular basis.

Determine whether or whether the store’s contact with consumers and suppliers is properly encrypted.

4. Avoid acquiring excessive sensitive data

Collecting and storing as little client data as possible is an efficient approach to secure an eCommerce shop in the case of a data breach or theft. This safeguard is based on the basic premise that attackers can’t steal something you don’t have. As a result, eCommerce businesses should only gather the information that is ostensibly required to complete a transaction and deliver the product.

As a result, businesses may avoid collecting social security numbers, birth dates, and other unneeded sensitive client data, ensuring that their operations remain secure even if a data breach occurs.

5. Be careful with suspicious activity

Ecommerce retailers may defend themselves from fraudulent purchases by keeping an eye on unusual behavior in their stores. Accounts and transactions can be monitored for red flags such as inconsistencies in billing and shipping information, as well as the customer’s actual location.

Furthermore, retailers can employ software tools that track client IP addresses and notify them if the addresses point to nations with a high number of fraudsters. As a result, frequent site monitoring may assist organizations in guarding against potentially suspicious behavior that could lead to measurable frauds in the future.

6. Anti-fraud solutions

There are several fraud protection software options on the market today. Depending on how much labor is required in the installation and ongoing administration, these tools might be rather different. Some companies prefer hands-on solutions, while others prefer to delegate them to professionals. The following are among the anti-fraud solutions available to eCommerce merchants:

Anti-fraud tools for beginners: These are usually built into online shopping carts and eCommerce platforms. They use machine learning techniques to detect fraudulent transactions using IP geolocation, email address validation, device fingerprinting, and address verification. At every one time, such tools execute extremely specialized and unique duties.

Mid-level anti-fraud tools: Chargeback guarantees, auto rejecting or high-risk orders, safeguards against new account e-commerce fraud detection, and account takeover protection is among the features offered by mid-level anti-fraud solutions.

Top-tier anti-fraud solutions: These systems include outsourced case management, competence dealing with big merchants, loyalty eCommerce fraud detection management, policy abuse protection, automated decisions, and manual evaluation of questionable transactions, among other features. These technologies ensure that the program does not reject any legitimate orders.

7. Address verification service (AVS)

Address verification service (AVS) is a service provided by credit card processors and issuing banks to detect suspicious credit card digital transactions and prevent credit card fraud. This service verifies that the billing address entered by the cardholder corresponds to the cardholder’s billing address on file with the bank that issued the card.

This verification happens when the merchant asks the payment processor to authorize the credit card transaction. When the addresses don’t match, the system either rejects or flags the transaction for further inquiry. The most prevalent application of this eCommerce fraud detection approach is in payment processing. Ecommerce merchants must use a payment processor that has an AVS.

8. Purchase limitation

Based on order kinds and business income trends, eCommerce merchants can establish restrictions on the number of transactions and total dollar value they will accept from a single account in a single day. If eCommerce fraud detection occurs, the merchant’s risk is reduced to a minimum.

Furthermore, Chargebacks911 believes that merchant mistakes account for 20 to 40% of chargebacks. Avoiding imprecise billing descriptions or perplexing return rules that irritate honest consumers will help you prevent chargebacks.

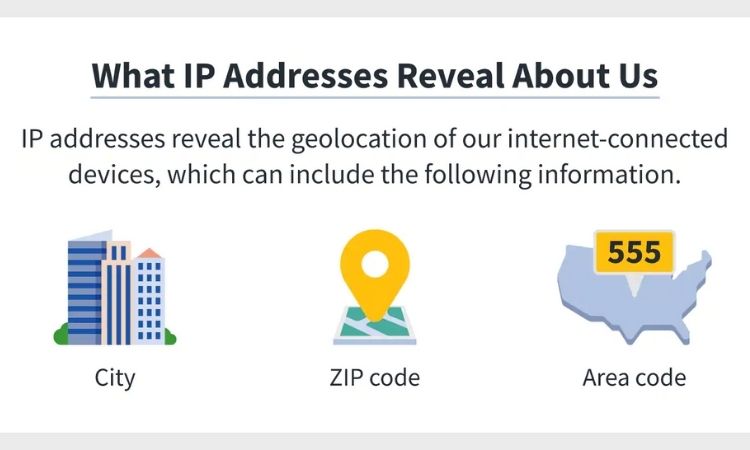

9. Cross-check IP address and credit card address

Every order placed on the eCommerce web business has a unique public IP address linked with it (i.e., a string of numbers separated by periods that identifies each computer using the internet protocol). The geographic location or city of the consumer making the online transaction can typically be deduced from the IP address. This is a red flag for the transaction if the city or area does not match the address on the credit card being used. This may be a powerful fraud-prevention tool since it can detect and report fraudulent orders in their early stages.

Online businesses should also avoid shipping orders to PO boxes and other virtual addresses, such as freight forwarders, in addition to following these best practices. Fraudsters generally keep their physical addresses hidden and prefer to use a PO Box or another anonymous place to avoid discovery. Fraudsters know that the police won’t be able to figure out a virtual address that isn’t physical.

Any eCommerce business’s chances of eliminating all scams are slim to none. If merchants take these eCommerce fraud detection procedures seriously, they may significantly decrease the impact of fraud on their profit margin.

10. Delivery tracking is a must

![]()

If you haven’t already, add tracking numbers and identification upon delivery to your E-Commerce platform. This sort of chargeback fraud is referred to as “friendly,” yet being vulnerable to criminals posing as your customers or suffering a big financial loss as a result of the mistakes of your actual customers is everything but nice.

If you don’t have an automatic solution for eCommerce fraud detection yet, you’ll have to manually store all previous data. It is much easier to prevent future such instances and provide this knowledge to the ML system when you have a database of every fraudulent effort, whether successful or not (once you have it). Keep an eye on your adversaries by keeping a thorough notebook with every hacker assault information on which you may base your future security plan. You can recognize some trends on your own and be aware of nations or places that may be harmful.

11. Machine Learning-Based Fraud Solutions

Data Processing in Real-Time

Traditional detection methods can only deal with scenarios that have occurred in the past and can only prevent the sorts of eCommerce fraud detection that have occurred previously. The system will only be able to draw a proper conclusion if an attempt is successful. Machine Learning is distinct because algorithms can examine changes in real-time and, in certain circumstances, respond to a fraudulent effort even before it occurs.

Finding Hidden Patterns

A machine learning system is always learning. It’s not just adept at uncovering underlying connections that humans can’t, but with each new hazard found, it becomes better at uncovering new situations and averting them.

Detection of proxy servers and virtual private networks (VPNs)

Isn’t it true that an honest customer doesn’t require a VPN while making a purchase? Of course, some people are worried about the protection of their personal information, but proxy users are likely to be suspected clientele who should be investigated further.

Analytical Behavior

When the system understands each client’s usual behavioral patterns, it can quickly detect variations and questionable conduct. It’s not always simple to see a thief breaking into a customer’s account.

Verifications that are both quick and accurate

Automated verification may speed up the entire purchase process for the customer and operate according to predefined criteria, reducing the risk of human error.

Taking Advantage of Big Data

An ML-based system can handle massive amounts of data without the need for a big staff of analysts, saving money. This might be a significant component in combating and avoiding eCommerce fraud detection if you have a large-scale firm constantly adding layers of information.

III. Conclusion

The number of eCommerce companies is increasing all around the world. Due to the current COVID-19 epidemic, the amount of online purchases and transactions is particularly high. This tendency, however, has resulted in an increase in fraudulent activity. As a result, online merchants must use eCommerce fraud detection and prevention software.

A company should carefully evaluate the options given by relevant firms in the field of eCommerce fraud detection and prevention and select the best choice — for example, machine learning-based algorithms that can improve over time and identify new fraudulent trends.

Read more:

- How To Get More Reviews On Shopify Stores To Boost Sales In 2022

- Identify 5+ Best Email Automation Triggers in 2022

- Top Social Media Content Proven to Leverage Ecommerce Business 2022

- Top 7 Important Requirement For Landing Page A/B Tests With Amazing Results

- Ultimate Guides and Tips To Sell Etsy Digital Downloads 2022